By JOHN JANNARONE And DANA CIMILLUCA

News Corp.'s board is set to decide Wednesday whether to proceed with a split of the media conglomerate into two companies, carving the bigger and more profitable entertainment businesses from the newspapers.

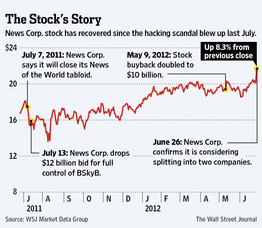

If the board approves the split, News Corp. is expected to announce the restructuring Thursday morning, said a person familiar with the situation. News Corp. stock jumped 8.3% Tuesday to its highest level since 2007 after the company confirmed it was contemplating a split, without giving any details.

News Corp. is mulling splitting its 20th Century Fox film studio, Fox broadcast network and Fox News channel from its newspapers, book publishing assets and education businesses. News Corp.'s publishing assets include The Wall Street Journal, the Times of London, the Sun and The Australian newspaper, as well as HarperCollins book publishing.

Executives from parts of News Corp., including editors from newspapers, were briefed in New York Tuesday on the potential restructuring.

The idea of the breakup is front and center almost exactly a year after a scandal blew up with the revelation that one of News Corp.'s U.K. tabloids had hacked the voice mail of a missing 13-year-old girl who turned out to be murdered. The scandal forced the closure of the News of the World newspaper, resignations of several senior executives and abandonment of News Corp.'s bid for the 61% of British Sky Broadcasting Group PLC it doesn't already own.

The spinoff idea has been in gestation for several years, said people familiar with the situation, although Rupert Murdoch, News Corp.'s chairman and chief executive, had until recently opposed the idea. He has recently warmed to it, the people said.

The phone hacking scandal added to a discomfort among some investors with the newspapers, which carry lower profit margins than News Corp.'s entertainment businesses. Newspapers as an industry have been hurt by the transition of readers and advertisers to the Internet, though the Journal has added subscribers and shields much of its content behind a Web paywall.

If a split occurs, the entertainment company is likely to attract investors who prefer faster-growing businesses and lucrative operations like cable channels.

At the same time the publishing company is expected to come out of the split with cash and no debt, positioning it to make acquisitions of newspapers or in the education sector, said people familiar with the situation. But it will also put more of a spotlight on publishing's results, highlighting different performances of various parts of the businesses that are now not disclosed in detail.

The split is expected to occur as a spinoff, with shareholders in News Corp. getting stock in the new publishing company at a ratio commensurate with existing stakes. The family of Mr. Murdoch, which controls News Corp. with a roughly 40% voting stake, is expected to maintain effective control of the two companies.

Mr. Murdoch would oversee both companies, likely retaining the chief executive role at the entertainment company, according to a person familiar with the situation. It isn't clear yet who would be CEO of the publishing company.

News Corp.'s Moves

Read about some of the media company's big moves over the years.

Calling It Splits

Several companies have announced plans to split themselves apart in recent years. Read about some of them

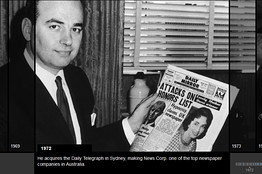

The publishing company would be much smaller than the entertainment business, which now accounts for 75% of News Corp.'s revenue and roughly 90% of its profits. The publishing company could be worth around $3 billion and the entertainment business over $50 billion, according to analyst estimates.

Analysts say that investors will pay more for every dollar of earnings from the entertainment company than the existing company.

Nomura Securities analyst Michael Nathanson estimates that if the entertainment company stock traded at the same earnings multiple as rival Walt Disney Co., it would be worth $23.06 a share, compared with Tuesday's price of $21.76 for the entire company. Mr. Nathanson expects the entertainment businesses' operating profit to grow 14% annually from fiscal 2011 to fiscal 2014, a rate he says is "the fastest in our media universe."

The publishing company, meanwhile, may be worth $1.17 a share, he estimates, putting a total value on the two stocks of more than $24.

One big question is how a split would affect the company's 39.1% stake in BSkyB. News Corp.'s phone-hacking scandal has prompted Ofcom, BSkyB's regulator, to examine whether the company is "fit and proper" to hold a broadcasting license.

Another hurdle News Corp. faced in its effort to buy the rest of the company was a need to convince British authorities that the deal wouldn't harm media "plurality" in the country.

Analysts including Citigroup's Thomas Singlehurst said that a split-up of News Corp. would go a long way toward setting aside the plurality issue if the company that houses BSkyB renews the effort to buy the rest of it, given that the two News Corp. entities would have separate boards, shareholders and managements.

The prospect that a restructuring could revive prospects for a bid drove up BSkyB shares by 1.24% Tuesday in London.

Addressing "fit and proper" concerns may be more difficult, analysts said, given that Mr. Murdoch and his son James, who is also expected to take a senior role at the entertainment business, have been widely criticized in the U.K. for their handling of the phone-hacking affair.

News Corp. has publicly apologized for wrongdoing at its U.K. tabloid and has said it is assisting police, who are conducting various criminal probes into reporting practices. Rupert and James Murdoch have conceded they didn't move fast enough to deal with the scandal and apologized, but have denied being aware of illicit activities.

"These issues will linger," Claudio Aspesi, an analyst at Sanford C. Bernstein & Co. said Tuesday. "Political obstacles related to the Murdochs' role in the U.K. won't go away."

Analysts expect expenses related to the phone-hacking scandal to be manageable. In the nine months through March 31, the company said it has spent $167 million on the investigations, mostly on fees for outside lawyers and advisers. Sanford C. Bernstein analyst Todd Juenger says the entertainment company may remain liable for any future claims from the hacking, but he sees those costs remaining less than $1 billion. "Given the size of the company, most investors just shrug it off," he said.

Write to John Jannarone at john.jannarone@wsj.com and Dana Cimilluca at dana.cimilluca@wsj.com

A version of this article appeared June 27, 2012, on page A1 in the U.S. edition of The Wall Street Journal, with the headline: News Corp. Advances Plan to Split Up.

![[image]](https://iza-server.uibk.ac.at/pywb/dilimag/20210113092156im_/http://si.wsj.net/public/resources/images/BF-AD064_INVEST_A_20120629154226.jpg)

![[image]](https://iza-server.uibk.ac.at/pywb/dilimag/20210113092156im_/http://si.wsj.net/public/resources/images/MK-BV389_HOUGHT_C_20120701170025.jpg)

![[image]](https://iza-server.uibk.ac.at/pywb/dilimag/20210113092156im_/http://si.wsj.net/public/resources/images/MI-BP829_curry_C_20120701170605.jpg)

![[image]](https://iza-server.uibk.ac.at/pywb/dilimag/20210113092156im_/http://si.wsj.net/public/resources/images/NY-BT061_SWIM_C_20120701193212.jpg)

![[image]](https://iza-server.uibk.ac.at/pywb/dilimag/20210113092156im_/http://si.wsj.net/public/resources/images/P1-BG850_SCYTHE_C_20120629173254.jpg)

![[image]](https://iza-server.uibk.ac.at/pywb/dilimag/20210113092156im_/http://si.wsj.net/public/resources/images/OB-TO602_boxila_C_20120628203443.jpg)

Most Recommended

“Try and fathom the hypocrisy of ...;”

“Perhaps, Mr Gensert, it's not th...;”

“Another thoughtful and concise...;”

“However, Ms Napolitano immediate...;”

“My thought, exactly...You go on...;”